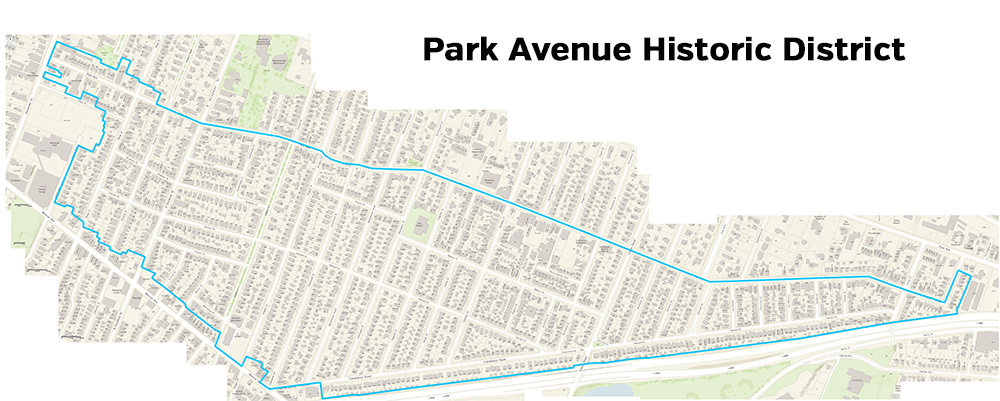

Park Avenue Historic District

Park Ave. is Porches tees are back!

Hurry! Quantities are limited!

These super comfy tees were designed by local artist Virginia McDonald

Park Ave. is Porches T-Shirt – $25

Park Ave. is Porches T-Shirt – $25

Super soft Next Level Tri-Blend Crew. Vintage black. Available in men’s/unisex or women’s sizing. NOTE: Women’s sizes tend to run small.

Park Ave. is Porches Baseball Tee

Park Ave. is Porches Baseball Tee

Super soft Next Level Tri-Blend 3/4 Sleeve Raglan. Premium heather / heather white. Available in unisex sizing.

PARK AVENUE HISTORIC DISTRICT IS OFFICIAL!

It’s official! As of February 20, 2020, the National Park Service officially approved the Park Avenue Historic District for listing in the National Register of Historic Places. This honorary program does not place any restrictions on private property owners. It does allow homeowners in the district to take advantage of the NYS Historic Homeowners Tax Credit program.

The blue outline below indicates the boundaries of the historic district. Click on the image to enlarge it.

>>Click here to learn more about the NYS Historic Homeowners Tax Credit program

If you have specific questions about the tax credit program, you can contact Christina Vagvolgyi with the NY State Historic Preservation Office (SHPO) at: 518-268-2217 or Christina.Vagvolgyi@parks.ny.gov.

>>Click here to learn more about the National Register of Historic Places

FAQs

Who qualifies for the NYS Historic Homeowners Tax Credit program?

Owner occupied homes located in a qualifying census tract and a National Register historic district.

What type of work qualifies for tax credits?

Kitchens & bath remodels, porch repairs, paint, HVAC, window repairs, floor refinishing, etc. Landscaping and garages/carriage houses, and appliances do not qualify.

How do I apply for tax credits?

Before beginning any work, complete an application detailing your proposed work. Submit to the State Historic Preservation Office.

Does listing our neighborhood in a National Register Historic District restrict what I can do to my home?

NO.

What’s the difference between a National Register Historic District and a City Preservation District?

A City Preservation District is a part of the City of Rochester’s Zoning Code. Alterations to the exterior of properties within a Preservation District require a Certificate of Appropriateness. Demolition is prohibited. National Register districts offer no protections or restrictions when private money is being used.

Still have QUESTIONS? Contact Caitlin Meives.